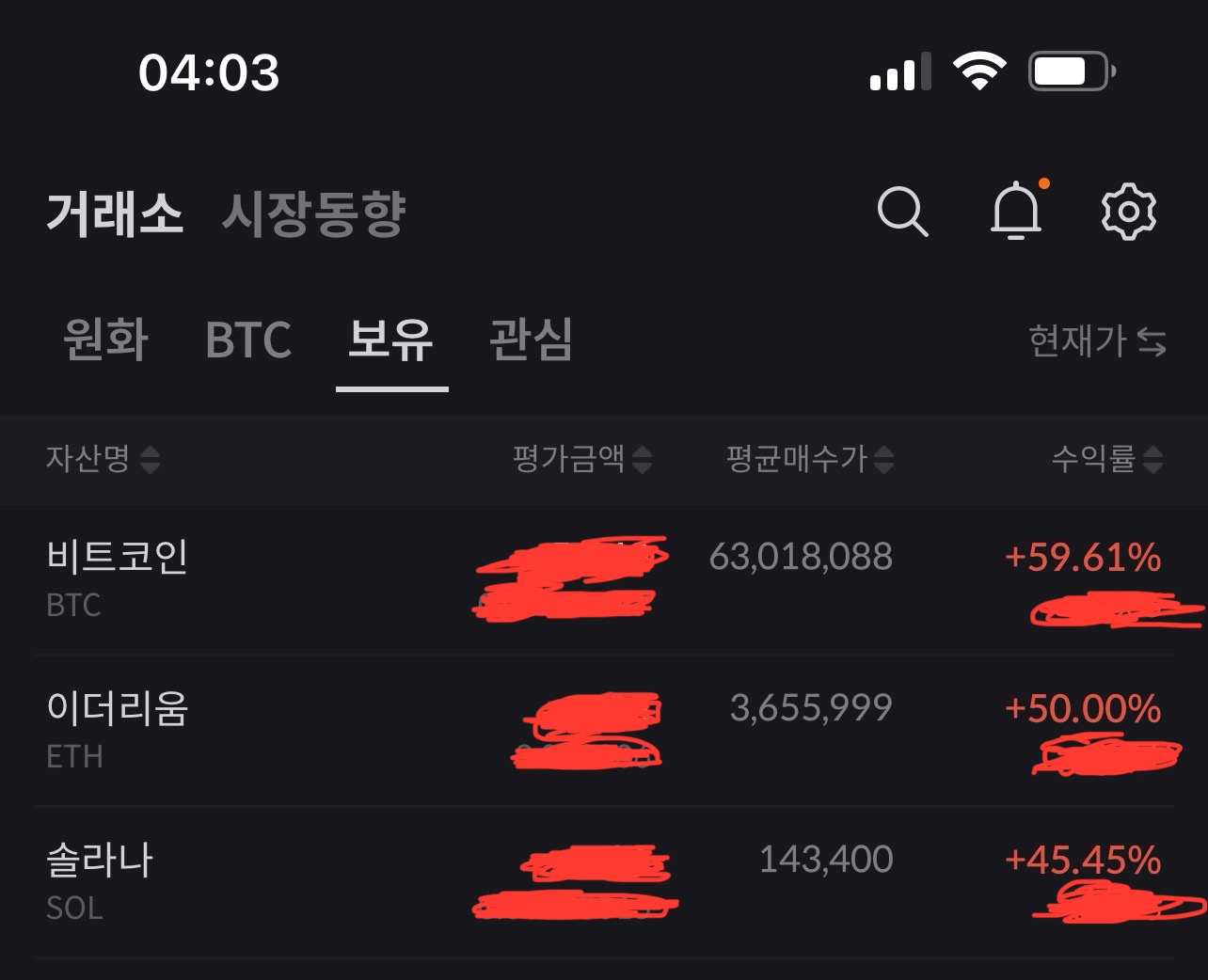

The image displays a mobile app interface, showcasing remarkable gains in the cryptocurrency market based on the purchase prices. Specifically, Bitcoin (BTC) is noted for its initial price of 63,018,088, achieving an impressive yield of +59.61%. Ethereum (ETH) is recorded at an acquisition cost of 3,655,999, yielding a +50.00% return, and Solana (SOL) has a purchase price of 143,400, with gains of +45.45%.

These yields present an exhilarating prospect for investors, highlighting the cryptocurrency market’s significant volatility. This arena is distinguished by its potential to offer investors sizable returns in relatively short periods, albeit with the risk of substantial losses. The noted surges may signify positive market perceptions, technological progress, or impactful economic occurrences.

However, investors are advised to exercise caution. The high-risk nature of cryptocurrency investments and the market’s volatility underscore the unpredictability of maintaining such gains. Investment choices should be cautiously made, grounded in comprehensive information, aligned with personal investment objectives, tolerance to risk, and possibly, the counsel of investment professionals.

While the current profits might generate excitement and satisfaction, they also serve as a reminder of the cryptocurrency market’s inherent instability. The lure of high returns in the crypto sphere is undeniably captivating, yet it also necessitates a prudent approach and future planning. This juxtaposition mirrors the reality that demands both eagerness and strategic insight.